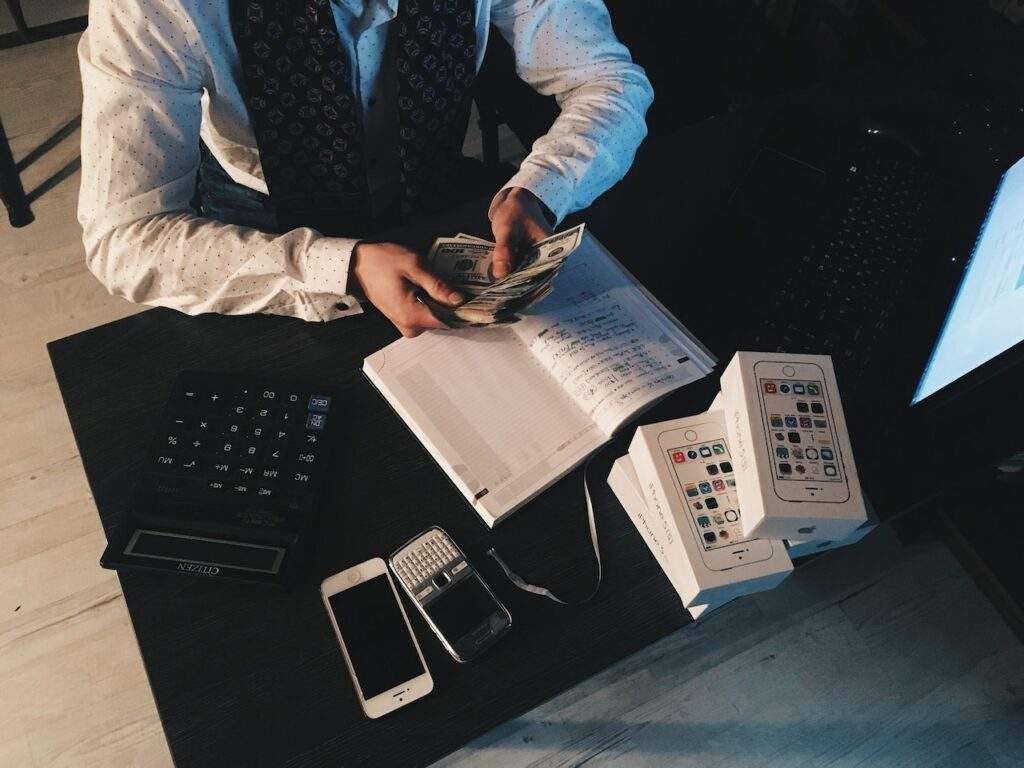

Regardless of the scale of business, one thing usually remains constants there. That is the importance of cash. It rules the market and business like a king. This is what gains the respect and importance of having an accounts receivable collections software. It is to make the collection of the money as swift as possible. The reason is that a good pace of cash receiving will further provide the structure of your business, growth, and crucial investments.

You have the liberty to use any available browser to tackle all the pending invoices. You can revert for each of them accordingly. It can be Fixed by a system where an automatic reminder is shipped to the customer. It can triggered one to 2 days before the payment day of the month. Email triggers can get your payment done quickly. These tools enable you to receive the income reports in real-time. You’ll be able to plan the longer-term steps yet, Because the cash-flow by tracking all the dates. These are designated for receiving the payments by customers as per their commitment.

Your staffer will handle the collection’s activity more efficiently now. You’ll be having all the updated data regarding the purchasers you’ve got reached bent. Note and run their response and therefore the tentative payment date in the course of this accounts receivable automation software. Therefore the better part is that the shoppers can reply to you regarding the payment reminders you’ve sent. It’ll automatically appear in account receivables

Daily sales outstanding

The collections initiate with a daily sales outstanding accounting ratio. Don’t worry these heavy accounting words or acronyms aren’t here to bring any quite confusion. The daily sales outstanding tells us about the remaining days before one needs to collect the due payment. It’s advisable to gather the due as soon as possible. Because this can account for having more cash and better growth. However, it’s easier said than done, and determining a way to reduce the gathering time is that the key here.

Luckily, we are here to inform you about the four additions you’ll be able to make to your account receivables to reinforce the progress of payment and collection. In these following steps, we’ve also talked about a crucial aspect that has proved itself to produce prompt actions and improved these tasks, even more, we are here talking about the accounts receivable management system.

1. SENDING BILL WITH CORRECT DURATION

You have to send the bills to your customers in an exceedingly so that the collection process can get the speed up instantly. But unfortunately, the billing process is typically suspended. the explanation which could seem genuine here is that the presence of varied stands like graphic designers, manufacturers, salesman, and repair provider. and also the least emphasized one here is that the bookkeeper.

Since the delay within the billing often leads to more delay for the payment and worst situation it’s ignored. Having followed a manual process can cause challenges and here comes QuickBooks which removes these forms of issues. It helps within the segregation and professional invoice output with a prompt email process.

2. ACHIEVE THE FLUENCY IN PAYMENT PROCES

Don’t hold yourself watching for the cheque to return. We talked about how cash rules the business as a king except for most of the purchasers, the foremost convenient way for paying is with their MasterCard. Don’t deny the payment by offering them another mode of payment after they are willing to try it with theirs.

The accounts receivable management system allows you to simply accept all payments from any mode. you’ll provide them with a secure payment link within the mail that they’ll click upon and do the remainder at their convenience. Your QuickBooks will get an automatic update once the payment has been received furthermore as sending the confirmation to the customer for the identical.

3. STAY UPDATED WITH DEMANDS AND TRENDS

The plan for many of the purchasers initially is to pay you on time but sometimes this gets forgotten. Now you have got to decide on how you would like to handle the customer in such a situation without losing them. The account receivable will facilitate yours here in managing your daily collections from the QuickBooks and preparing the AR aging summary.

4. POCKET IN MORE TIME WITH AR

You won’t meet any happy business owner who is unable to pay ample time in additional productive works like bringing in innovations or polishing their services. Bookkeeping could be a secondary thing for the business owners and that they try and make it automated quickly.

The primary step during this would be negating the manual entry process and this can prevent a hefty business day where you’re ended up doing piles of manual sales entry. Accounts receivable software integration helps in making the matches between all the deposits with the financial statement automatically while the important sales data gets securely imported into QuickBooks.